It is most popular and useful among all the systems of recording business transactions. The arithmetical accuracy of posting can be tested by trial balance. Final accounts prepared under this system not only give correct profit but also the correct financial position of the business. It also helps in comparative study.

This system is based on the assumption that every transaction has two aspects- debit and credit. In order to understand debit and credit we will have to know the effect of business transaction. Business transaction is an event which requires transfer of money value . it is just like third rule of Newton that every action has an opposite reaction. When we purchase a book we pay its price in rupees. If we do not pay him at the moment shopkeeper becomes our creditor. Thus every transaction affects two sides, accounts or aspects. We have many transactions in a business which have to be properly recorded. For this purpose we have a book called “ledger”. Ledger has a separate account for each item and such accounts are opened on different pages of ledger. Each account has two sides – debit an credit. Increase in recorded on one side and decrease on the other side of the account.

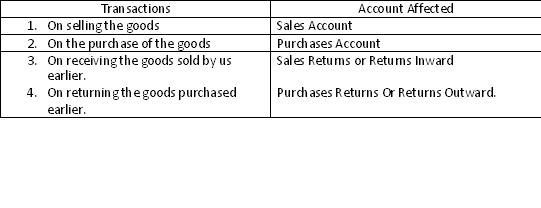

An important item or account in a business is goods i.e. the commodity or service businessman is dealing in. Goods are recorded in books under four different accounts as follows: